Cost of Goods Manufactured Formula

The cost of goods manufactured COGM is a calculation that is used to gain a general understanding of whether production costs are too high or low when compared to revenue. Hence Cost of Goods Sold can be calculated as.

Cost Of Goods Manufactured Template Download Free Excel Template

Cost of Goods Sold Beginning Inventory Purchases during the year Ending.

. The Silk ends the year with 30000 ending work-in-process inventory. The purchases of stock in trade were Rs 6000 Cr. The costs for manufacturing these parts are.

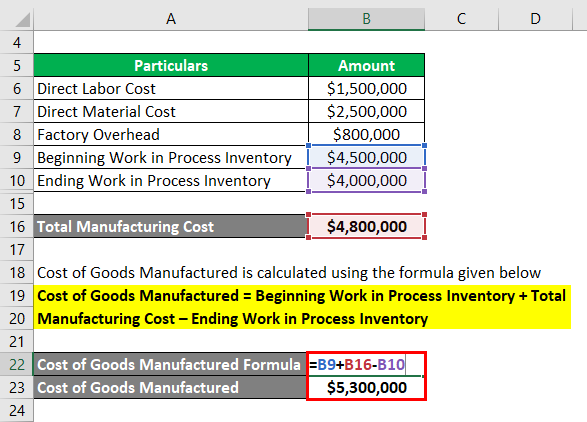

We will use these values. The cost of goods manufactured equation is calculated by adding the total manufacturing costs. 100000 40000 50000 30000 - 60000 160000.

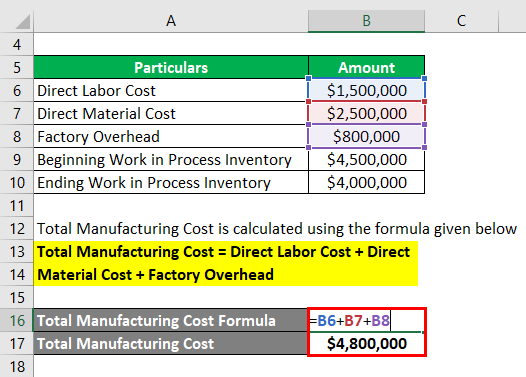

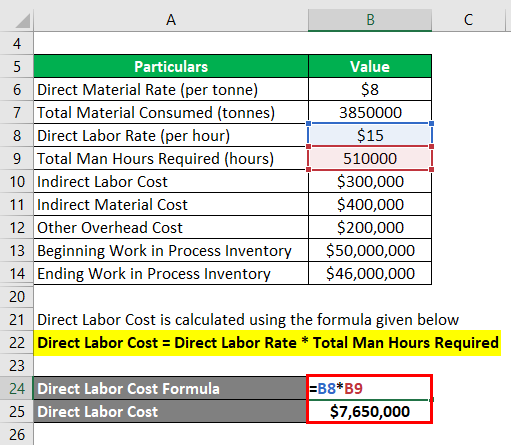

Otherwise it is the price of the resources of your. First we need to reach the direct labor cost by multiplying. Use these four steps to compute total manufacturing costs for a product or business.

Understanding your company starts with an understanding of your companys costs. Calculate the cost of goods manufactured. Including all direct materials direct labor and factory overhead.

To make informed decisions and to keep track of your companys profitability. Beginning Work in Process Inventory. Cost of goods manufactured formula Other costs.

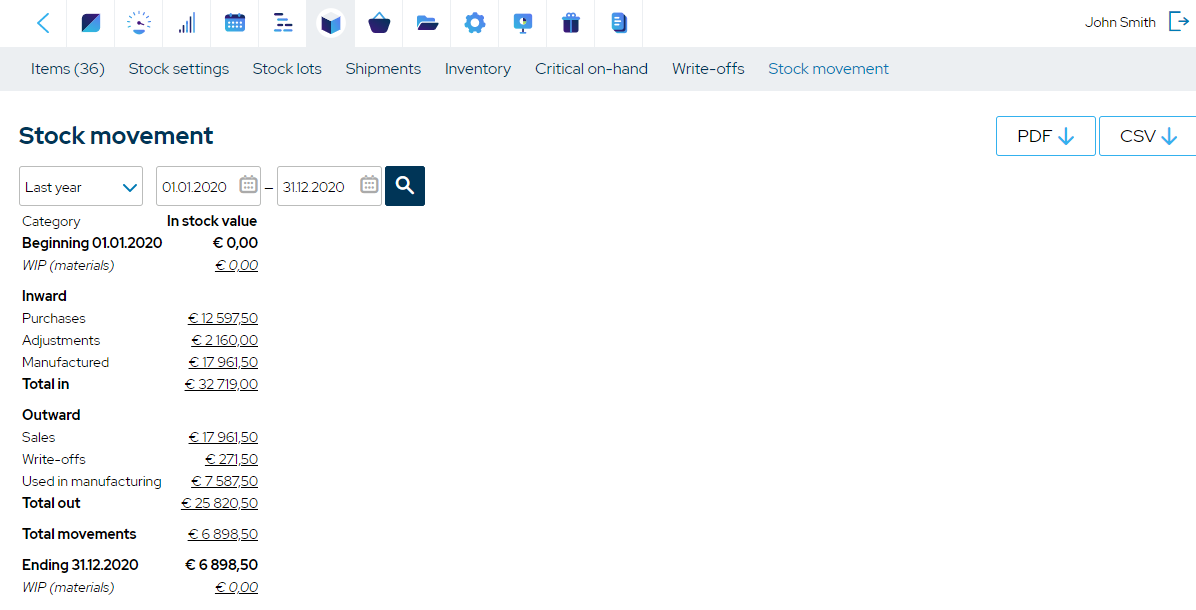

Direct materials direct labor manufacturing overhead total manufacturing cost. Cost of goods manufactured formula helps maintain a businesss budget and helps identify production-related problems. Beginning work in process WIP inventory Total manufacturing cost direct materials labor overhead - Ending WIP inventory COGM.

The cost of goods manufactured COGM is an accounting term that refers to a statement showing a companys total production costs within a specific period. The Cost of Goods Manufactured COGM represents the total costs incurred in the process of converting raw material into finished goods. The cost of goods manufactured is the cost per unit of product manufactured work performed or service rendered.

ABC Furniture Store calculates its cost of goods manufactured for the year as. The COGM formula starts with the beginning-of. The cost of goods.

It is the best way to maximize the profitability of a. To the beginning work in. Then the beginning WIP inventory Cost of goods not finished in the accounting period and ending WIP costs are 35000 and 45000 respectively.

150000 75000 105000. Hence the cost of goods manufactured will be 136647400 and per unit it will be 1366474 when divide it by 100.

How To Calculate The Cost Of Goods Manufactured Cogm Mrpeasy

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Compute Cost Of Goods Manufactured Youtube

Cost Of Goods Manufactured Formula Examples With Excel Template

Comments

Post a Comment